7 de julio 2018

Children of Exile: The Births “Sowing Hope” in the Camp of Nicaraguan Farmers

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

Banks warn that government “interference” could “generate widespread distrust in the financial system.”

Pressure and threats emanating from Nicaragua’s Bank Regulatory Board (Superintendencia) were rejected outright by business owners

Pressure and threats emanating from Nicaragua’s Bank Regulatory Board (Superintendencia) were rejected outright by business owners, producers and lawyers. A new banking measure announced on Tuesday, June 26, orders the private banks to identify full names of the clients who have withdrawn more than US $50,000 from their accounts since April 19. This has been termed an action that will harm the necessary trust that exists between the clients and the banking institution of their preference.

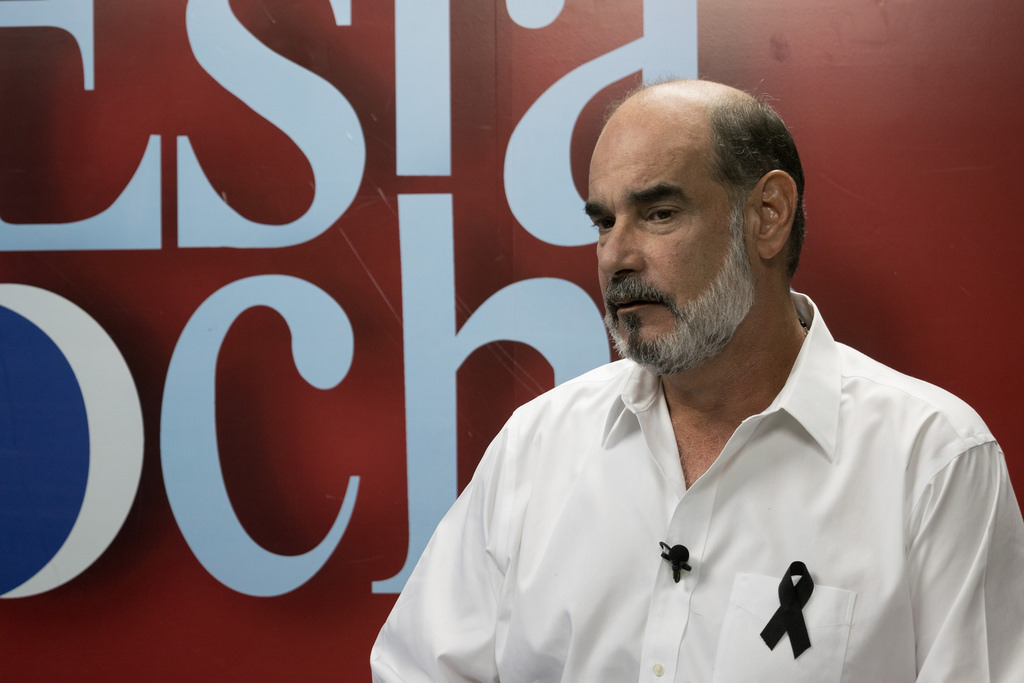

Alejandro Aguilar, a specialist in banking matters, said the key is knowing exactly what additional information the Banking Superintendent is unofficially asking for. “It’s extremely worrisome, because no official entity can try to obtain information in a manner that’s not approved under the law, and later try to apply a fine for that. I see it as an abuse of authority,” was his verdict.

Three banks have been hit with fines for not providing the information, according to the president of the Superior Council of Private Enterprise (Cosep), which is one of the groups alleging that the information is being requested for “political” reasons.

Alejandro Aguilar, Nicaraguan attorney and specialist in banking matters. Photo: Confidencial

Aguilar says having a bank turn over to the government information regarding a customer’s personal operations generates a climate of distrust in the bank, and this could lead to a far greater danger.

“If the state suspects that someone (a bank official) isn’t being “loyal,” they can take the measures they consider pertinent, but they can’t obligate the bank to turn over information that the Law doesn’t give them access to,” he maintained.

“The law is clear that suspending a bank’s confidentiality policy is done on a case-to-case basis and with a judge’s order when someone is involved in a crime. No law awards the SIBOIF (Regulatory agency for the banks and financial system) faculties to suspend the protections in a general way. If that were to occur, it would be the end of the financial system,” he alleged.

Aguilar recalled that “all over the world, the banking system is built on operations of trust between the client and the bank, and if that relationship of trust is fractured and disappears, you’ve undermined the backbone of your financial system.”

Michael Healy, president of the Nicaraguan Agricultural Producers Union (UPANIC), terms the Regulatory Board’s attitude “a policy of interference”, since the banking system has its own norms and regulations.

“We’re totally opposed to that request,” which is a threat to the bank’s confidentiality,” Healy declared in an interview on the weekly television news program Esta Semana (“This week”) that’s broadcast in Nicaragua over Channel 12. “You can’t obligate the bank to tell you how much each customer is withdrawing, because that’s a private relationship between the client and bank. The government and the Bank Regulatory Board don’t necessarily have the right to know that,” he stated.

Michael Healy, president of UPANIC. Photo: Carlos Herrera / Confidencial

In his view, the motivation behind this unprecedented request is “to exercise more pressure on the private sector. The government has peen pressuring this sector in different ways, because after April 18th they broke off their bilateral relationship with the government,” he argued.

“The Bank Regulator needs to understand that if they continue to pressure, asking for information that the banks aren’t obligated to give, this will create a greater impact in the national economy, especially the financial system. You shouldn’t play with fire. If the projections from the Nicaraguan Foundation for Economic and Social Development are of a 5.8% shrinkage in the economy this year, this measure could increase the drop far more,” he warned.

“I believe that the Bank Regulatory Board, the Superintendent, and also the president of the Central Bank should reflect on what information they have a right to request, and not pressure the banking system to turn over other information, something that’s totally illegal.”

“The confidentiality of the banks must be protected. The financial system in Nicaragua has had a lot of success since its founding, due to the fact that the bank policy of confidentiality has been strengthened, and we shouldn’t destroy it,” Healy concluded.

Economist Alejandro Arauz notes that the Regulators run a great risk if they continue with that line of action. “The bank lives off of the savings that people deposit, and this measure could impact all of the banks’ clients,” since “people can choose to keep their money at home, and that would have an impact on the banks.”

“The Bank Regulator is breaking with the policy of bank confidentiality when it asks for that information, and that could generate a widespread distrust of the banking system,” he assured.

“Another aspect of this is the threat that the Central Bank of Nicaragua would refuse to provide them with funds, despite the fact that by law it has to do so. With that measure, they’re creating an additional risk to the banking system, one that could have repercussions in the Country Risk Ranking, if the risk assessors lower still further the country’s rank,” he alerted.

Arauz wondered what sense the Regulator’s demand makes. If they want to control the exit of capital, he notes that there are other mechanisms for achieving that same thing. “I don’t know what the objective is. As an economist, I tell you that I don’t understand it. It’s a very opaque measure.”

Another who reacted with perplexity is businessman Gabriel Pasos, who up until five weeks ago was a member of the managing board if the Bank Regulatory Board and Other Financial Institutions (Siboif). He feels that the situation proposed is “a very delicate matter. A very sensitive topic: public confidence is the most important element of a financial system.”

Pasos assured that “I never saw anything like this in the years that I was there”, until the day he resigned at 10 pm on May 30th, following the massacre perpetrated during the Mothers’ Day March

If Urcuyo’s request is “totally unexpected,” the sanction from the Nicaraguan Central Bank “is beyond contemplation. There are penalties, fines, sanctions, but I don’t believe that any such article exists in the law,” he declared.

Confidencial consulted a high-level source within the Banking Regulatory Agency, which limited itself to saying that “the communique requested general information, in terms of the conduct of deposits by segments. That’s what the Regulatory Superintendent expressed in his written communication, so that the banks’ response can’t be based on presumptions or interpretations.”

Jose Adan Aguerri, president of the Superior Council of Private Enterprise (COSEP). Photo: Carlos Herrera / Confidencial

The private sector closed ranks in their support for the national banking system, even though the Nicaraguan Private Bank Association abstained from offering any public comment in defense of its members.

Jose Adan Aguerri, Cosep president, repeats that the Regulatory Board’s request “is totally illegal,” and has been rejected by the private sector. “There’s no regulation that allows this entity to know who’s withdrawing money and who isn’t,” he sustained.

Aguerri assured that “the banks should maintain a firm position, that even if they’re fined, they need to protect the bank’s confidentiality. You can’t play with breaking confidentiality for political reasons because that goes against the duties of a financial system.”

The banks have been “clear and firm that they’re not going to fall into this game, and they’re not going to give out that information,” although three of them may have already been fined, he noted.

What’s happening “is for political manipulation. It’s a directed action, like what they’re doing with the land invasions. Now it doesn’t only affect people of the private sector with selective actions, but they’re also wanting to identify who are the people that are withdrawing resources, for reasons of political manipulation, and that’s unacceptable,” he finalized.

Archivado como:

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D